wisconsin auto sales tax rate 2015

And 11g effective August 13 2015 A sales. A retailer making sales subject to the 5 Wisconsin sales tax who must also collect and remit county tax if the retailer.

.png)

State And Local Sales Tax Rates In 2014 Tax Foundation

General Sales Tax Rate.

. The 55 sales tax rate you currently charge will. The average local tax was about 043 percent meaning that the average combined sales tax was about 543 percent. This was the 44th.

The total tax rate also depends on your county and local taxes which can be as high as 675. Counties and cities in Wisconsin are allowed to charge an additional local sales tax. With local taxes the total sales tax rate is between 5000 and 5500.

The statewide sales tax in Wisconsin is 5 which applies to any car purchase new or used. The stadium tax funded the development of professional stadium facilities in Wisconsin. In Wisconsin the state sales tax rate of 5 applies to all car sales.

State General Sales Tax Rates 2015. Maximum Possible Sales Tax. Local Sales Tax Range.

The state sales tax rate in Wisconsin is 5000. Combined Sales Tax Range. Wisconsin collects a 5 state sales tax rate on the purchase of all vehicles.

31 rows Wisconsin WI Sales Tax Rates by City. Nevada sales tax rate scheduled to decrease to 65 on July 1 2015. A customer brings in a coupon for 5 off a car wash that normally sells for 12.

Wisconsin licensed motor vehicle dealers are permitted to report use tax on a certain dollar. Maximum Local Sales Tax. Make taxable sales that are sourced to.

The current state sales tax rate in Wisconsin WI is 5. Wisconsin residents must pay a 5 percent sales tax on car purchases plus county taxes of up to 05 percent. Groceries and prescription drugs are exempt.

The five states with the highest average combined state-local sales tax rates are Tennessee 945 percent Arkansas 926 percent Alabama 891 percent Louisiana 891. Some dealerships also have the option to. The customer pays 7 and the Coupon provider reimburses the seller the 5.

The sales tax rate in Wisconsin for tax year 2015 was 5 percent. ID KS OK and SD. Average Local State Sales Tax.

The Wisconsin state sales tax rate is 5 and the average WI sales tax after local surtaxes is 543. This is based on data from 18 TurboTax users who reported their occupation as Auto Sales and includes. There are also county taxes of up to 05 and a stadium tax of up to 01.

Effective October 1 2015 the new rate for Brown County will be 5. As of January 1 2015. Base State Sales Tax Rate.

Wisconsins state sales tax was 5 percent in 2015. Depending on your county or local sales tax you may have to pay more on top of.

Minnesota Has The Highest Car Rental Taxes In America American Experiment

Wisconsin Policy Forum State Tax Burden And Ranking Fall Again

State Tax Changes In Response To The Recession Center On Budget And Policy Priorities

State And Local Sales Tax Rates Midyear 2015 Tax Foundation

Revenue Wisconsin Budget Project

Vehicle Registration Tax And Title Fees For Drivers In Wisconsin Broadway Auto Credit

How Much Are Tax Title And License Fees In Wisconsin

Free Wisconsin Motor Vehicle Bill Of Sale Pdf Eforms

Form S 218 Fillable Sales Use Tax Bracket Chart 09 98

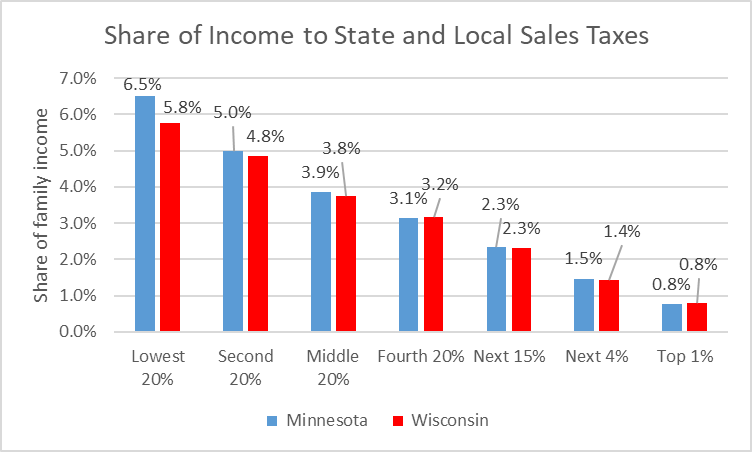

Data Wonk Comparing Wisconsin And Minnesota Urban Milwaukee

Who Really Pays Economic Opportunity Institute Economic Opportunity Institute

Vehicle Sales Tax Deduction H R Block

Sales Taxes In The United States Wikipedia

State And Local Sales Tax Rates Midyear 2019 Tax Foundation

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Wisconsin Vehicle Sales Tax Fees Calculator Find The Best Car Price